Cigar Tax Wars 1863-1868

How Civil War taxes affected the cigar industry

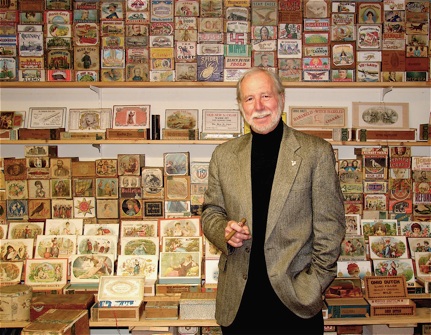

A Cigar History Museum Exclusive

© Tony Hyman

Modified and cleaned January 5, 2011

Cigar Tax Wars 1863-1868

How Civil War taxes affected the cigar industry

A Cigar History Museum Exclusive

© Tony Hyman

Modified and cleaned January 5, 2011

The U.S, Civil War (aka: War Between the States) initiated a bevy of new taxes, the story of which is detailed in another exhibit. One result of those taxes was a century of tax-related legislation that plagued cigar makers, including the requirement that all cigars leave the factory in specific consumer-size packages, each package identified as to maker and origin of the contents, adorned with an excise stamp. Imposing these, and other laws, on a huge widely scattered industry known for its independence was not easy. This exhibit is a detailed look at some of those laws, how the cigar industry resisted and ultimately gave in and obeyed...sort of.

______________

Congress cared about collecting taxes, and every one of those rules (and others not mentioned) was designed to help IRS officials do exactly that. Neither Congress nor the IRS placed restrictions on cigar quality, ingredients, selling price or on what could be said, claimed or pictured on a box of cigars. When examining any cigar box, today’s collectors and historians must always keep in mind that only the ID, CN, Revenue stamp and tax-class notice (after 1917) are required by law to be true. Everything else on a box is part of an unregulated million-man free-for-all, the most democratic explosion of marketing creativity and advertising in the history of the world.

At the close of the War Between the States the processing, packaging and marketing of food, drink and tobacco products was in its infancy. In the business-driven atmosphere of the post-War world, tradition was out the window. Every manufacturer of consumer products sought newer, better, faster and cheaper ways of doing things because to do so meant you would survive, perhaps prosper, and maybe even strike it rich.

The concept of consumer size packaging was still new, as was the technology to make it happen. Mass produced paper, cardboard and bottles were recent developments. The capability of printers to put color text and pictures on those packages even newer. Commercial life became a giant experiment in production, quality control, distribution, package design, packaging materials, advertising, marketing, delivery, storage, theft prevention, tax evasion and bribing government officials. With no great body of experience to learn from, the cigar industry tackled those problems with style and ingenuity that has never been equaled.

The U.S. cigar industry single handedly turned the first few decades after the Civil War into the most important period in the history of advertising and package design. Selling cigars became an outrageous free-for-all involving hundreds of thousands of entrepreneurs, each convinced he had the best ideas for separating smokers from their nickels. The inside of cigar boxes evolved from blank paper to a magnificent billboard upon which every ploy used by modern advertisers was first tried. Before World War One, all the themes, concepts, gimmicks, designs, styles, patterns, wordings, and novelties of modern advertising had been tried and proven. No product in history has been packaged in greater variety than the cigar.

Signs

This sign not in the NCM collection.

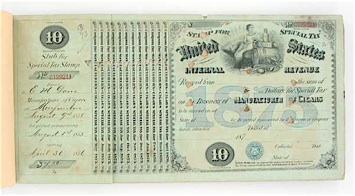

Licenses

Unused licenses are cancelled by holes punched in the license.

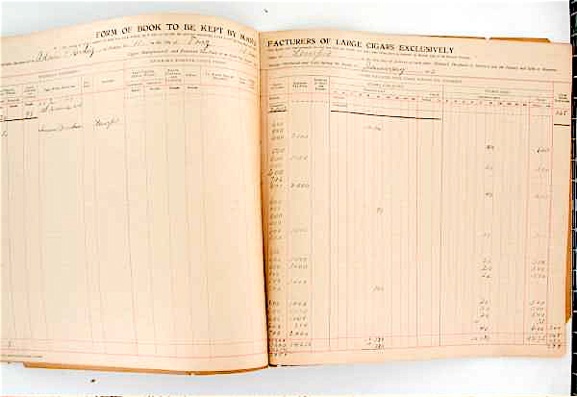

Inventory

The shooting War Between the States ended in 1865, but the tax war raged on. After conducting hearings concerning abuses by both impound-happy bribe-taking tax inspectors and their tax dodging adversaries, Congress overhauled and expanded the law over the next few years to the point where cigar makers became the most highly regulated craftsmen in America. Employees were bonded. Tax Laws of 1868 added pages of rules so strict and specific that if you carried an armful of cigar tobacco from one room in your home or shop to another, you were required to fill out a federal form recording that you did so. Daily inventories of tobacco, cigars and cigar boxes were required.

Left hand page: “Articles on hand on the first day of January, or at the time of commencing or concluding business, articles purchased, and goods manufactured.” Columns left to right: Date / Pounds of Leaf Tobacco, Actual Weight / Pounds of Leaf Tobacco Resweated / Pounds of Cuttings, Scraps, &c, to be used for Fillers / From Whom Purchased / Business Location / Cigars, Cheroots and Cigarettes, over 3 lbs. per Thousand Manufactured / Cigarettes, not over 3 lbs. per Thousand Manufactured / Cigar Boxes: 25’s / 50’s / 100’s / 200’s / 250’s / 500’s / Segar Stamps: 25 / 50 / 100 / 200 / 250 / 500 / Cigarette Stamps: 10 / 20 / 50 / 100. Bottom of left page: Total for this month / Total to be accounted for / Sold, Consumed, Returned, &c. / On Hand, last day of month.

Right hand page: “Materials sold or returned; Cigars, Cheroots and Cigarettes Sold or Removed and Cigar Boxes and Stamps Used.” Columns left to right: / Pounds of Leaf Tobacco, Actual Weight / Pounds of Leaf Tobacco Resweated / Pounds of Cuttings, Scraps, &c, to be used for Fillers / Pounds of Stems, Scraps, and Waste Unfit for Cigar Stock / To Whom Sold or Returned / Business Location / Cigars, Cheroots and cigarettes, over 3 lbs. per Thousand Sold or Removed / Cigarettes, not over 3 lbs. per Thousand Sold or Removed / Cigars, Cheroots and cigarettes, over 3 lbs. per Thousand Removed in Bond for Export / Cigarettes, not over 3 lbs. per Thousand Removed in Bond for Export / Cigar Boxes: 25’s / 50’s / 100’s / 200’s / 250’s / 500’s / Segar Stamps: 25 / 50 / 100 / 200 / 250 / 500 / Cigarette Stamps: 10 / 20 / 50 / 100. Bottom of right page: Number of new hands employed during month _____ / Number of hands discontinued during month _____ / Number of hands employed on the last day of the month _____.

The six-year tax war (1863-1868) between cigar factories and the Federal Government pitted a government eager for money against thousands of large and small cigar factories determined not to give it to them. This ultimately one-sided war covered a few dozen major battles involving deceit, ruse and run-around by the cigar makers and ever-tightening regulations by the IRS. The cigar makers lost every battle, and eventually joined the ranks of the law abiding... at least most of them. Thousands of small makers, especially rural part-timers, continued to evade the tax man for another 80 years.

When a tax man walked in the door and began to physically count the factory’s inventory, cigar makers protested, “Hey, you collected taxes on those last month.” Given that tax collectors were patronage appointees, good ol’ boys who had helped or were related to some politician, it’s no surprise they were befuddled by masses of cigars that all looked pretty much alike. Many tax collectors found it impossible to know which cigars were tax paid and which were newly made. Many others found the confusion a convenient cover for bribery and pay-offs.

Congress responded with an 1864 law requiring cigars to be put in “boxes or bundles” so they could be counted. Cigarmakers countered with an assortment of oddly shaped bundles containing heaven knows what and how many. The government ended that nonsense in 1865 by requiring that every domestic cigar be packed in boxes of 25, 50, 100, 250 and 500, whether the factory rolled 50 cigars each day or 50,000. The American cigar box was officially born. Legislated to life. Cigars became the first product to have a federally mandated consumer size package, the law specifying not only the number of cigars but the form and material of the package. Before that law was passed, as few as one in ten domestic cigars passed from roller to smoker in consumer-size boxes.

Tax stamps & Caution Notices

Revenue stamps and Caution Notices remain a requirement until the late 1950’s. Because government constantly fiddled with tax laws, revenue stamps were changed about thirty times during that period, making them very useful in dating a box.

See Dating Cigar Boxes for examples of stamps and CN.

Hard to read a century and a half later, but the tax assessor did his figuring directly on the box as the law required.

LA FLORA, 1866 NWO box of 100.

One of many 1868 regulations stipulated that each box of cigars must be branded or incised with the name of the maker (later his factory number), state and tax district in which the factory was located, and the number of cigars packed in the box. This is called a box’s “ID” and is very useful to identify what is and what isn’t a cigar box. An I.D. is important information when describing a box to collectors as many seek boxes from a particular state, region or factory. The first ID’s were somewhat freehand, branded in the manner of the days when cigars were shipped in crates and barrels. Later laws made them circular, the size of a quarter. These and future laws further changing I.D.’s are discussed in detail in Dating Factory ID’s.

I.D.

GEN. U.S. GRANT, re-used box with 1866 and 1868 stamps.

CHOICE, illegal use of two 1872 50 count stamps on box of 100.

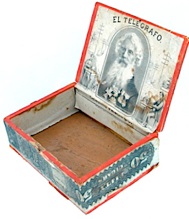

EL TELEGRAFO, illegal application of stamp, unbroken when opened.