Import Taxes 1791 - 1882

An overview

A Cigar History Museum Exhibit

© Tony Hyman

Modified: October 25, 2009

Cleaned January 5, 2011

Import Taxes 1791 - 1882

An overview

A Cigar History Museum Exhibit

© Tony Hyman

Modified: October 25, 2009

Cleaned January 5, 2011

The 2nd law passed by the first Congress of the United States in 1789 declared: “It is necessary for the support of the Government, for the discharge of the debts of the United States, and for the encouragement and the protection of manufactures, that duties be laid on imported goods, wares, and merchandise.” A tax law! George Washington signed this act. Madison, Lee, Carroll, Gerry, Sherman and other founders of the Government favored it. So did Alexander Hamilton (the first Secretary of the Treasury), and Thomas Jefferson (the first Secretary of State), who wrote that “American prohibitions and American high duties are necessary to meet foreign high duties and foreign prohibitions, and to foster American industries.”

Sometimes high, sometimes low, but the United States has never been without an import tax since.

In the next year, and in 1791, 1792, 1794, 1795, 1797, and 1800 stronger acts were passed, imposing taxes (called duties) for protection upon a great number of additional articles, so that ten such acts were passed and signed before Washington turned the Presidency over to John Adams. Three more were passed within the next four years, and two others in 1807 and 1808.

When the War of 1812 began, the duties were doubled: five acts imposing additional duties were passed in 1812, 1813, 1815, and 1816. In 1816, under the lead of Henry Clay and John C. Calhoun, a more thorough protective tariff was enacted, in which the number of laws bearing specific import taxes was increased so greatly that the Federal Government dropped all other taxes between 1817 and the start of the Civil War in 1861. There were no federal income, property, excise or license-based taxes for 44 years thanks to money derived from taxing imports.

The same protective (and income producing) policy shaped the acts of 1818, 1819, 1824, 1825, the two of 1828, the act of 1830 and two more acts in 1832.

In 1833, for the first time, under Andrew Jackson, the first Democratic President, a movement was made in the direction of lower duties. Calhoun, who originally favored protectionism, supported the move and forced Clay to offer a compromise tariff which called for a gradual reduction of import taxes over the next ten years. The Panic and recession of 1837 hurt newly developing industrializing America and ultimately led to a new protective tariff in 1842. Four years later, in 1846, the Senate was equally divided on whether to reduce the high tariff. The democratic Vice-President cast the deciding vote, repealing the Act of 1842. The revenue tariff of 1846 and even lower tariff of 1857 became the law of the land. Interestingly, more Cuban cigars were imported into the United States under the low tax laws of 1857 than at any other year in our history.

When Southern states withdrew their Senators and left the Union in the days prior to the Civil War, the remaining Republican senators enacted the protective tariff of 1861 raising taxes from the 1857 low of 24%. From 1861, thru the war, and until 1872, the general tendency of the nineteen tariff acts passed was to both raise income as well as improve and perfect the protective system by adjusting it to new features of foreign trade and the needs of new industries established in the United States.

In 1862, as heavy internal taxes were falling on the citizenry, Representative Morrill, a vigorous proponent of tariff said to the House Ways and Means Committee as they debated raising import duties: “It will be indispensable for us to revise the tariff on foreign imports, so far as it may be seriously disturbed by any internal duties, and to make proper reparation, otherwise we shall have destroyed the goose that lays the golden eggs. If we bleed [our] manufacturers we must see to it that the proper tonic is administered at the same time.” Representative Stevens explained, saying the intent was to impose additional duties upon imports equal to the tax which they had put upon the comparable domestic articles.

During the remainder of the War, Congress was snowed under by legislation and other activities relevant to the financing and conducting of the War. As a result, they had neither the time nor the inclination to spend a lot of time and resources studying the effects, or the equitability, of the war time Tariff. They turned to domestic producers for advice as to what duties were necessary to keep their businesses from being ruined, so the easiest course of action was to follow their suggestions. As a result a goodly number of import taxes were higher than necessary.

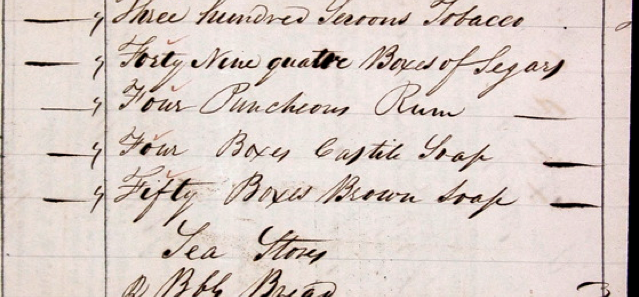

The stamp required on all boxes of cigars imported into the US in 1867 is almost 13” long. The building is the U.S. Treasury in Washington DC. Although 10,000,000 cigars were imported from Cuba and elsewhere, these stamps are rare, on or off a box. Please contact the Cigar History Museum if you find one.

After the civil War, there was an immediate public cry for the removal of internal taxes that had been imposed: income tax, license fees, stamp taxes, and personal property taxes. Congress responded to their constituency: between 1866 and 1872 the majority of the internal taxes were repealed. A few import taxes met the same fate, usually because the tax had been shown to be unnecessary or, in some cases, to hurt local industries more than they helped. There was a huge war debt to deal with, so the majority of import duties remained at wartime levels.

In the Act of 1872, the first general reduction of 10% of all duties then in force was made, and further reductions were made to specified items, and hundreds of items were added to the free list. Tea and Coffee were two notables made free, since there was no American tea or coffee in competition.

The see-saw battle of protection or no continued in 1875 when the 10% reduction was repealed, duties on sugar were raised greatly (which seriously hurt Cuba, then our greatest source of the powder). The free list was left in force. In 1879 quinine was added to the free list, and in 1882, the extra duties automatically added to goods from East Africa, India and the Orient was repealed.

A Tariff Commission was created in 1882, which lead to a general revision, reducing taxes on a good many items, adding others to the free list. Important items with reduced import taxes included wool, woolen goods, and various types of iron.

Let me know if you want me to write “the rest of the story.”

Import Taxes